Takeaways From Finance Minister Nirmala Sitharaman's Union Budget 2022-23

India’s economic growth in the current year is estimated to be 9.2 per cent, highest among all large economies. The overall, sharp rebound and recovery of the economy from the adverse effects of the pandemic is reflective of our country’s strong resilience. This was stated by Union Minister for Finance and Corporate Affairs Smt Nirmala Sitharaman while presenting the Union Budget in Parliament today.

The Finance Minister said, India is celebrating Azadi ka Amrit Mahotsav and it has entered into Amrit Kaal, the 25-year-long leadup to India@100, the government aims to attain the vision of Prime Minister outlined in his Independence Day address and they are:

Complementing the macro-economic level growth focus with a micro-economic level all-inclusive welfare focus,

Promoting digital economy & fintech, technology enabled development, energy transition, and climate action, and

Relying on virtuous cycle starting from private investment with public capital investment helping to crowd-in private investment.

Since 2014, the government’s focus has been on empowerment of citizens, especially the poor and the marginalized and measures have been taken to provided housing, electricity, cooking gas, and access to water. The government also have programmes for ensuring financial inclusion and direct benefit transfers and a commitment to strengthen the abilities of poor to tap all opportunities.

The Finance Minister informed that the Productivity Linked Incentive in 14 sectors for achieving the vision of AtmaNirbhar Bharat has received excellent response, with potential to create 60 lakh new jobs, and an additional production of Rs 30 lakh crore during next 5 years. Dwelling on the issue of implementation of the new Public Sector Enterprise policy, She said, the strategic transfer of ownership of Air India has been completed, the strategic partner for NINL (Neelanchal Ispat Nigam Limited) has been selected, the public issue of the LIC is expected shortly and others too are in the process for 2022-23.

Smt Nirmala Sitharaman emphasized that this Budget continues to provide impetus for growth. It lays a parallel track of (1) a blueprint for the Amrit Kaal, which is futuristic and inclusive, which will directly benefit our youth, women, farmers, the Scheduled Castes and the Scheduled Tribes. And (2) big public investment for modern infrastructure, readying for India at 100 and this shall be guided by PM GatiShakti and be benefited by the synergy of multi-modal approach. Moving forward, on this parallel track, She outlined the following four priorities:

PM GatiShakti

Inclusive Development

Productivity Enhancement & Investment, Sunrise Opportunities, Energy Transition, and Climate Action

Financing of Investments

Elaborating the PM GatiShakti, the Finance Minister said that it is a transformative approach for economic growth and sustainable development. The approach is driven by seven engines, namely, Roads, Railways, Airports, Ports, Mass Transport, Waterways, and Logistics Infrastructure. All seven engines will pull forward the economy in unison. These engines are supported by the complementary roles of Energy Transmission, IT Communication, Bulk Water & Sewerage, and Social Infrastructure. Finally, the approach is powered by Clean Energy and Sabka Prayas – the efforts of the Central Government, the state governments, and the private sector together – leading to huge job and entrepreneurial opportunities for all, especially the youth.

Similarly, PM GatiShakti Master Plan for Expressways will be formulated in 2022-23 to facilitate faster movement of people and goods. The National Highways network will be expanded by 25,000 km in 2022-23 and Rs 20,000 crore will be mobilized through innovative ways of financing to complement the public resources.

She added that contracts for implementation of Multimodal Logistics Parks at four locations through PPP mode will be awarded in 2022-23.

In Railways, the Finance Minister said that ‘One Station-One Product’ concept will be popularized to help local businesses & supply chains. Moreover, as a part of Atmanirbhar Bharat, 2,000 km of network will be brought under Kavach, the indigenous world-class technology for safety and capacity augmentation in 2022-23. She also informed that four hundred new-generation Vande Bharat Trains with better energy efficiency and passenger riding experience will be developed and manufactured and one hundred PM GatiShakti Cargo Terminals for multimodal logistics facilities will be set up during the next three years.

On Agriculture front, the Finance Minister informed that Chemical-free Natural Farming will be promoted throughout the country, with a focus on farmers’ lands in 5-km wide corridors along river Ganga, at the first stage. Use of ‘Kisan Drones’ will be promoted for crop assessment, digitization of land records, spraying of insecticides, and nutrients. She said, to reduce dependence on import of oilseeds, a rationalised and comprehensive scheme to increase domestic production of oilseeds will be implemented.

As 2023 has been announced as the International Year of Millets, the government announced full support for post-harvest value addition, enhancing domestic consumption, and for branding millet products nationally and internationally.

Smt Nirmala Sitharaman said, implementation of the Ken-Betwa Link Project, at an estimated cost of Rs 44,605 crore will be taken up aimed at providing irrigation benefits to 9.08 lakh hectare of farmers’ lands, drinking water supply for 62 lakh people, 103 MW of Hydro, and 27 MW of solar power. Allocations of Rs 4,300 crore in RE 2021-22 and Rs 1,400 crore in 2022-23 have been made for this project. Moreover, Draft DPRs of five river links, namely Damanganga-Pinjal, Par-TapiNarmada, Godavari-Krishna, Krishna-Pennar and Pennar-Cauvery have been finalized and once a consensus is reached among the beneficiary states, the Centre will provide support for implementation.

The Finance Minister underlined that the Emergency Credit Line Guarantee Scheme (ECLGS) has provided much-needed additional credit to more than 130 lakh MSMEs to help them mitigate the adverse impact of the pandemic. She, however added that the hospitality and related services, especially those by micro and small enterprises, are yet to regain their pre-pandemic level of business and after considering these aspects, the ECLGS will be extended up to March 2023. She informed that its guarantee cover will be expanded by Rs 50,000 crore to total cover of Rs 5 lakh crore, with the additional amount being earmarked exclusively for the hospitality and related enterprises.

Similarly, Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) scheme will be revamped with required infusion of funds. This will facilitate additional credit of Rs 2 lakh crore for Micro and Small Enterprises and expand employment opportunities. She informed that Raising and Accelerating MSME Performance (RAMP) programme with outlay of Rs 6,000 crore over 5 years will be rolled out to make the MSME sector more resilient, competitive and efficient.

Udyam, e-Shram, NCS and ASEEM portals will be interlinked and their scope will be widened.

Dwelling on the subject of Skill development and Quality Education, the Finance Minister said that Startups will be promoted to facilitate ‘Drone Shakti’ through varied applications and for Drone-As-A-Service (DrAAS). In select ITIs, in all states, the required courses for skilling will be started. In vocational courses, to promote crucial critical thinking skills, to give space for creativity, 750 virtual labs in science and mathematics, and 75 skilling e-labs for simulated learning environment, will be set-up in 2022-23.

She said that due to the pandemic-induced closure of schools, children, particularly in the rural areas, and those from Scheduled Castes and Scheduled Tribes, and other weaker sections, have lost almost 2 years of formal education and mostly, these are children in government schools. Thus to impart supplementary teaching and to build a resilient mechanism for education delivery, the Finance Minister informed that ‘one class-one TV channel’ programme of PM eVIDYA will be expanded from 12 to 200 TV channels and this will enable all states to provide supplementary education in regional languages for classes 1-12.

A Digital University will be established to provide access to students across the country for world-class quality universal education with personalised learning experience at their doorsteps. This will be made available in different Indian languages and ICT formats. The University will be built on a networked hub-spoke model, with the hub building cutting edge ICT expertise. The best public universities and institutions in the country will collaborate as a network of hub-spokes.

Under Ayushman Bharat Digital Mission, an open platform for the National Digital Health Ecosystem will be rolled out and it will consist of digital registries of health providers and health facilities, unique health identity, consent framework, and universal access to health facilities.

The Finance Minister said, as the pandemic has accentuated mental health problems in people of all ages, a ‘National Tele Mental Health Programme’ will be launched for better access to quality mental health counselling and care services. This will include a network of 23 tele-mental health centres of excellence, with NIMHANS being the nodal centre and International Institute of Information Technology-Bangalore (IIITB) providing technology support.

Smt Nirmala Sitharaman announced an allocation of Rs 60,000 crore to cover 3.8 crore households in 2022-23 for Har Ghar, Nal Se Jal. Current coverage is 8.7 crores and of this 5.5 crore households were provided tap water in last 2 years itself.

Similarly, in 2022-23, 80 lakh houses will be completed for the identified eligible beneficiaries of PM Awas Yojana, both rural and urban and Rs 48,000 crore is allocated for this purpose.

A new scheme, Prime Minister’s Development Initiative for NorthEast, PM-DevINE, will be implemented through the North-Eastern Council to fund infrastructure, in the spirit of PM GatiShakti, and social development projects based on felt needs of the North-East. An initial allocation of Rs 1500 crore will enable livelihood activities for youth and women, filling the gaps in various sectors.

In 2022, 100 per cent of 1.5 lakh post offices will come on the core banking system enabling financial inclusion and access to accounts through 11 net banking, mobile banking, ATMs, and also provide online transfer of funds between post office accounts and bank accounts. This will be helpful, especially for farmers and senior citizens in rural areas, enabling interoperability and financial inclusion.

To mark 75 years of independence, the government has proposed to set up 75 Digital Banking Units (DBUs) in 75 districts of the country by Scheduled Commercial Banks to ensure that the benefits of digital banking reach every nook and corner of the country in a consumer-friendly manner.

The issuance of e-Passports using embedded chip and futuristic technology will be rolled out in 2022-23 to enhance convenience for the citizens in their overseas travel.

The Finance Minister announced that for developing India specific knowledge in urban planning and design, and to deliver certified training in these areas, up to five existing academic institutions in different regions will be designated as centres of excellence. These centres will be provided endowment funds of Rs 250 crore each.

The animation, visual effects, gaming, and comic (AVGC) sector offers immense potential to employ youth and therefore an AVGC promotion task force with all stakeholders will be set-up to recommend ways to realize this and build domestic capacity for serving our markets and the global demand.

Nirmala Sitharaman said that Telecommunication in general, and 5G technology in particular, can enable growth and offer job opportunities. She informed that required spectrum auctions will be conducted in 2022 to facilitate rollout of 5G mobile services within 2022- 23 by private telecom providers. A scheme for design-led manufacturing will be launched to build a strong ecosystem for 5G as part of the Production Linked Incentive Scheme, she added.

On the Defence front, the Government reiterates committed to reducing imports and promoting AtmaNirbharta in equipment for the Armed Forces. 68 per cent of the capital procurement budget will be earmarked for domestic industry in 2022-23, up from 58 per cent in 2021-22. Defence R&D will be opened up for industry, startups and academia with 25 per cent of defence R&D budget earmarked.

Referring to Sunrise Opportunities, the Finance Minister said, Artificial Intelligence, Geospatial Systems and Drones, Semiconductor and its eco-system, Space Economy, Genomics and Pharmaceuticals, Green Energy, and Clean Mobility Systems have immense potential to assist sustainable development at scale and modernize the country. They provide employment opportunities for youth, and make Indian industry more efficient and competitive.

To facilitate domestic manufacturing for the ambitious goal of 280 GW of installed solar capacity by 2030, an additional allocation of RS 19,500 crore for Production Linked Incentive for manufacture of high efficiency modules, with priority to fully integrated manufacturing units from polysilicon to solar PV modules, will be made.

Nirmala Sitharaman said that Telecommunication in general, and 5G technology in particular, can enable growth and offer job opportunities. She informed that required spectrum auctions will be conducted in 2022 to facilitate rollout of 5G mobile services within 2022- 23 by private telecom providers. A scheme for design-led manufacturing will be launched to build a strong ecosystem for 5G as part of the Production Linked Incentive Scheme, she added.

On the Defence front, the Government reiterates committed to reducing imports and promoting AtmaNirbharta in equipment for the Armed Forces. 68 per cent of the capital procurement budget will be earmarked for domestic industry in 2022-23, up from 58 per cent in 2021-22. Defence R&D will be opened up for industry, startups and academia with 25 per cent of defence R&D budget earmarked.

Referring to Sunrise Opportunities, the Finance Minister said, Artificial Intelligence, Geospatial Systems and Drones, Semiconductor and its eco-system, Space Economy, Genomics and Pharmaceuticals, Green Energy, and Clean Mobility Systems have immense potential to assist sustainable development at scale and modernize the country. They provide employment opportunities for youth, and make Indian industry more efficient and competitive.

To facilitate domestic manufacturing for the ambitious goal of 280 GW of installed solar capacity by 2030, an additional allocation of RS 19,500 crore for Production Linked Incentive for manufacture of high efficiency modules, with priority to fully integrated manufacturing units from polysilicon to solar PV modules, will be made.

Reflecting the true spirit of cooperative federalism, the Central Government enhanced the outlay for the ‘Scheme for Financial Assistance to States for Capital Investment’ from Rs 10,000 crore in the Budget Estimates to Rs 15,000 crore in the Revised Estimates for the current year. Moreover, for 2022-23, the allocation is Rs 1 lakh crore to assist the states in catalysing overall investments in the economy. These fifty-year interest free loans are over and above the normal borrowings allowed to the states. This allocation will be used for PM GatiShakti related and other productive capital investment of the states.

Smt Nirmala Sitharaman also announced that in 2022-23, in accordance with the recommendations of the 15th Finance Commission, the states will be allowed a fiscal deficit of 4 per cent of GSDP of which 0.5 per cent will be tied to power sector reforms, for which the conditions have already been communicated in 2021-22.

Concluding the Part A of her Budget speech, the Finance Minister said that the revised Fiscal Deficit in the current year is estimated at 6.9 per cent of GDP as against 6.8 per cent projected in the Budget Estimates. The Fiscal Deficit in 2022-23 is estimated at 6.4 per cent of GDP, which is consistent with the broad path of fiscal consolidation announced by her last year to reach a fiscal deficit level below 4.5 per cent by 2025-26. While setting the fiscal deficit level in 2022-23, she called for nurturing growth, through public investment, to become stronger and sustainable.

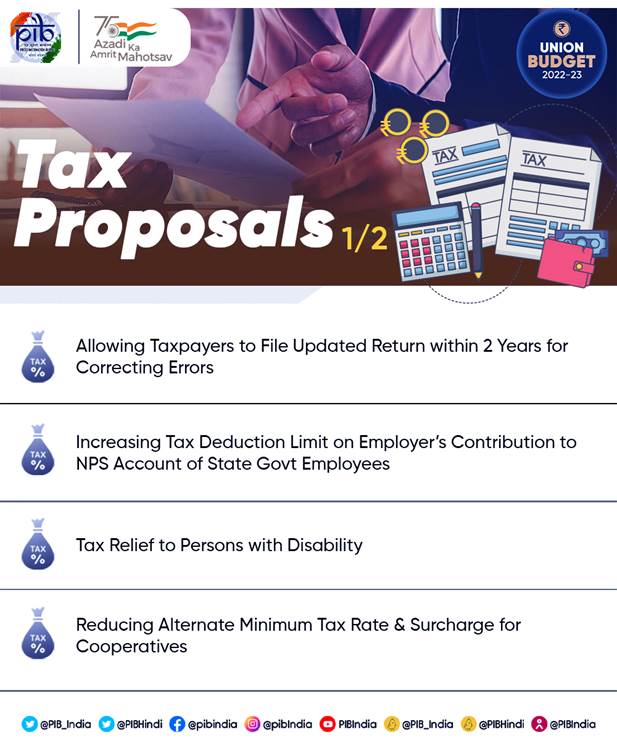

The Union Budget 2022-23, while continuing with the declared policy of stable and predictable tax regime, intends to bring more reforms that will take ahead the vision to establish a trustworthy tax regime. Smt Nirmala Sitharaman said that proposals relating to taxes and duties will further simplify the tax system, promote voluntary compliance by taxpayers, and reduce litigation.

On the Direct Tax side, the budget allows taxpayers to file updated income tax return within 2 years for correcting errors. It also provides tax relief to persons with disability. The budget also reduces Alternate minimum tax rate and surcharge for cooperatives. As an incentive for startups, period of incorporation of eligible startups has been extended by one more year. The budget proposes to increase tax deduction limit on employer’s contribution to NPS account of state government employees to bring parity with central government employees. Newly incorporated manufacturing entities will be incentivized under concessional tax regime. Income from transfer of virtual assets will be taxed at 30%. The budget proposes better litigation management to avoid repetitive appeals.

On the Indirect tax side, the Union budget says that Customs administration in Special Economic Zones will be fully IT driven. It provides for phasing out of concessional rates in capital goods and project imports gradually and apply a moderate tariff of 7.5%. The budget underlines review of customs exemptions and tariff simplification, with more than 350 exemptions proposed to be gradually phased out. It proposes that customs duty rates will be calibrated to provide a graded structure to facilitate domestic electronics manufacturing. Rationalization of exemptions on implements and tools for agri sector manufactured in India will be undertaken. Customs duty exemption to steel scrap will be extended. Unblended fuel will attract additional differential excise duty.

The budget proposes a new provision permitting taxpayers to file an Updated Return on payment of additional tax. This updated return can be filed within two years from the end of the relevant assessment year. Smt. Sitharaman said that with this proposal, there will be a trust reposed in the taxpayers that will enable the assessee herself to declare the income that she may have missed out earlier while filing her return. It is an affirmative step in the direction of voluntary tax compliance.

To provide a level playing field between co-operative societies and companies, the budget proposes to reduce Alternate Minimum Tax for the cooperative societies also to fifteen per cent. The Finance Minister also proposed to reduce the surcharge on co-operative societies from present 12 to 7 per cent for those having total income of more than Rs 1 crore and up to Rs 10 crores.

The parent or guardian of a differently-abled person can take an insurance scheme for such person. The present law provides for deduction to the parent or guardian only if the lump sum payment or annuity is available to the differently abled person on the death of the subscriber i.e. parent or guardian. The budget now allows the payment of annuity and lump sum amount to the differently abled dependent during the lifetime of parents/guardians, i.e., on parents/ guardians attaining the age of sixty years.

The Central Government contributes 14 per cent of the salary of its employee to the National Pension System (NPS) Tier-I. This is allowed as a deduction in computing the income of the employee. However, such deduction is allowed only to the extent of 10 per cent of the salary in case of employees of the State government. To provide equal treatment, the budget proposes to increase the tax deduction limit from 10 per cent to 14 per cent on employer’s contribution to the NPS account of State Government employees as well.

Eligible start-ups established before 31.3.2022 had been provided a tax incentive for three consecutive years out of ten years from incorporation. In view of the Covid pandemic, the budget provides for extending the period of incorporation of the eligible start-up by one more year, that is, up to 31.03.2023 for providing such tax incentive.

In an effort to establish a globally competitive business environment for certain domestic companies, a concessional tax regime of 15 per cent tax was introduced by the government for newly incorporated domestic manufacturing companies. The Union Budget proposes to extend the last date for commencement of manufacturing or production under section 115BAB by one year i.e. to 31st March, 2024.

For the taxation of virtual digital assets, the budget provides that any income from transfer of any virtual digital asset shall be taxed at the rate of 30 per cent. No deduction in respect of any expenditure or allowance shall be allowed while computing such income except cost of acquisition. Further, loss from transfer of virtual digital asset cannot be set off against any other income. In order to capture the transaction details, a provision has been made for TDS on payment made in relation to transfer of virtual digital asset at the rate of 1 per cent of such consideration above a monetary threshold. Gift of virtual digital asset is also proposed to be taxed in the hands of the recipient.

Taking forward the policy of sound litigation management, the budget provides that, if a question of law in the case of an assessee is identical to a question of law which is pending in appeal before the jurisdictional High Court or the Supreme Court in any case, the filing of further appeal in the case of this assessee by the department shall be deferred till such question of law is decided by the jurisdictional High Court or the Supreme Court.

It has been proposed in the budget that income of a non-resident from offshore derivative instruments, or over the counter derivatives issued by an offshore banking unit, income from royalty and interest on account of lease of ship and income received from portfolio management services in IFSC shall be exempt from tax, subject to specified conditions.

It has been clarified in the budget that any surcharge or cess on income and profits is not allowable as business expenditure.

In order to bring certainty and to increase deterrence among tax evaders, the Finance Minister proposed to provide that no set off, of any loss shall be allowed against undisclosed income detected during search and survey operations.

The budget says that reforms in Customs Administration of Special Economic Zones will be undertaken, and it shall henceforth be fully IT driven and function on the Customs National Portal with a focus on higher facilitation and with only risk-based checks. This reform shall be implemented by 30th September 2022.

The budget proposes to phase out the concessional rates in capital goods and project imports gradually and apply a moderate tariff of 7.5 per cent. Certain exemptions for advanced machineries that are not manufactured within the country shall continue. A few exemptions have been introduced on inputs, like specialised castings, ball screw and linear motion guide, to encourage domestic manufacturing of capital goods.

More than 350 exemption entries will be gradually phased out. These include exemption on certain agricultural produce, chemicals, fabrics, medical devices and drugs and medicines for which sufficient domestic capacity exists. Further, several concessional rates are being incorporated in the Customs Tariff Schedule itself instead of prescribing them through various notifications.

In the field of electronics, Customs duty rates are being calibrated to provide a graded rate structure to facilitate domestic manufacturing of wearable devices, hearable devices and electronic smart meters. Duty concessions are also being given to parts of transformer of mobile phone chargers and camera lens of mobile camera module and certain other items.

To give a boost to the Gems and Jewellery sector, Customs duty on cut and polished diamonds and gemstones is being reduced to 5 per cent. To facilitate export of jewellery through e-commerce, a simplified regulatory framework shall be implemented by June this year. To disincentivise import of undervalued imitation jewellery, the customs duty on imitation jewellery is being prescribed in a manner that a duty of at least Rs 400 per Kg is paid on its import.

Customs duty on certain critical chemicals namely methanol, acetic acid and heavy feed stocks for petroleum refining are being reduced, while duty is being raised on sodium cyanide for which adequate domestic capacity exists.

Duty on umbrellas is being raised to 20 per cent. Exemption to parts of umbrellas is being withdrawn. Exemption is also being rationalised on implements and tools for agri-sector which are manufactured in India. Customs duty exemption given to steel scrap last year is being extended for another year. Certain Anti- dumping and CVD on stainless steel and coated steel flat products, bars of alloy steel and high-speed steel are being revoked.

To incentivise exports, exemptions are being provided on items such as embellishment, trimming, fasteners, buttons, zipper, lining material, specified leather, furniture fittings and packaging boxes that may be needed by bonafide exporters of handicrafts, textiles and leather garments, leather footwear and other goods. Duty is being reduced on certain inputs required for shrimp aquaculture so as to promote its exports.

Blending of fuel is a priority of this Government. To encourage the efforts for blending of fuel, unblended fuel shall attract an additional differential excise duty of Rs 2/ litre from the 1st day of October 2022.