After 2 Years, 35pc of Companies See Offices Back in Almost Full Swing

As per a C-Suite Survey conducted by Colliers and Awfis, about 35% of the occupiers have seen a majority (75-100%) of employees returning to offices. This includes a hybrid way of working wherein employees come into the office a few times a week. After a gap of two years, return to offices has gathered momentum with ebbing Covid-19 cases, signifying positive occupier confidence. At the same time, about 74% of the occupiers are looking towards distributed workspaces as a strategy to shift from location-centric to people-centric workspaces. This will enable flexibility to employees while furthering productivity gains for businesses.

The Colliers-Awfis joint report explores the status of return to work across different sectors. It delves into how occupiers are likely to choose distributed workspaces and devise flex space strategies by understanding their current usage patterns and preferences.

Source: Colliers, Awfis

“The survey has made it clear that a distributed workspace strategy is the way to go for occupiers in this new era of experiential workplaces, as occupiers emerge from the after-effects of the pandemic. Flex spaces, in particular, are leading this growth, as occupiers from varied sectors are housing teams in flex centres across cities. This shift in strategy also reflects in the leasing by flex operators - flex operators leased about 3.5 million sq feet of space in H1 2022 across the top six cities, almost three-fourths of the flex leasing in entire 2021.

Further, the survey reveals that as occupiers straddle business goals and employee wellbeing together, about 74% of the occupiers are looking at the distributed workspace, and more than half of the IT/ITeS companies (the largest occupier group) prefer a distributed work model for their employees. Therefore, we can see opportunities for flex spaces not only in metro cities but also in non-metro cities. In fact, in non-metro cities, total flex spaces are likely to grow more than two-fold to 5.5 million sq feet by the end of 2022.” said Ramesh Nair, Chief Executive Officer | India and Managing Director, Market Development | Asia, Colliers.

Amit Ramani, Founder & CEO, Awfis said, “The findings of the survey are a testament to the success of the distributed work model and subsequently of flex spaces in catering to the ever-evolved workspace needs of India Inc. The survey unveils that currently 74% occupiers have adopted flex centres for their workspace needs given the multiple benefits associated with flex working. Going forward, 77% occupiers will include flex spaces as part of their workplace strategy. We expect exceptional demand in the future, driven largely by large corporates for de-densification of existing traditional offices.”

“Keeping employee centricity at the forefront, 79% of the occupiers feel that distributed workplace strategy will be highly beneficial to save time and money. Additionally, work-life balance, mental wellbeing and team productivity are fueled when opting for flex spaces.”, said Sumit Lakhani, Deputy CEO, Awfis.

Flex spaces emerged as the most preferred distributed workspace strategy of occupiers, owing to the ease of adoption and benefits for employees. Occupiers see dual benefits arising out of a distributed work in flex spaces. They view benefits from such a strategy will further enhance employees’ overall harmony, while bringing more cost efficiencies to their organization, added by Arpit Mehrotra, Managing Director | Office Services, South India and Head of Flex | India, Colliers.

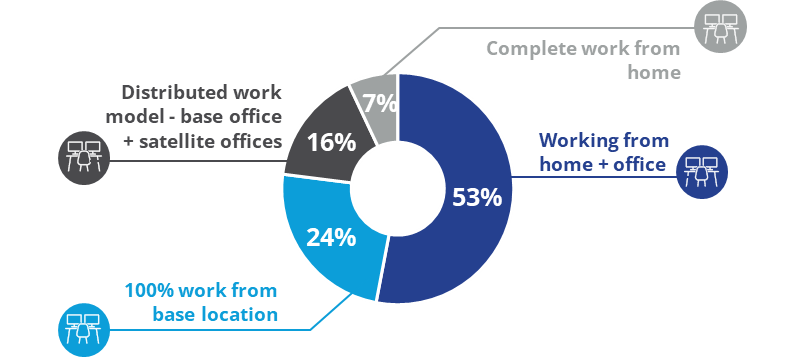

About 53% of occupiers prefer working from home + office as their preferred strategy

About 53% of the occupiers prefer a hybrid workplace plan for their employees, with working from home + office in varying degrees. Time and cost savings, increased employee convenience and overall well-being of employees are key priorities for occupiers, as they look to enable distributed workspace strategy. About 79% of the occupiers who are ready to opt for flex spaces see time and cost savings as major benefits. Clearly, pursuing business goals in tandem with benefits to employees is at the core of occupiers’ interest.

Occupiers’ preferred portfolio strategy

Source: Colliers, Awfis

Flex spaces emerge as the most popular way to enable distributed workspaces

In H1 2022, flex operators leased about 3.5 million sq feet, accounting for about 13% of the overall leasing, in line with the surging demand for flex space by occupiers. Almost half of the occupiers said they will prefer to adopt flex spaces as a mode to enable distributed workspace. Interestingly, even non-metro cities are seeing a growth of flex spaces as occupiers look towards distributed workspaces.

Key parameters for the adoption of flex space strategy for occupiers

Note: Rating has been calculated as an average of the count of the responses received for each parameter, indicating the importance of each parameter for the occupiers

Source: Colliers, Awfis

“About 90% of the occupiers from E-commerce and consulting sectors are likely to include flex space in their current portfolio. Occupiers see dual benefits arising out of distributed workspaces. They view time and cost-saving benefits followed by better work-life balance for employees.” said Vimal Nadar, Senior Director and Head of Research, Colliers India.